Regional personal insolvency statistics

The Australian Financial Security Authority (AFSA) released regional personal insolvency statistics for the December quarter 2016 in January. Next month new figures will be released, making for interesting comparisons.

The data has been broken down to state-by-state data sets. To read the full article, click here, or continue reading below:

AFSA’s statistics show the number of people who entered into a personal insolvency in the quarter. A personal insolvency is a formal arrangement under the Bankruptcy Act 1966. If people are having trouble managing their debts, there are actions that they can take before turning to these formal arrangements.

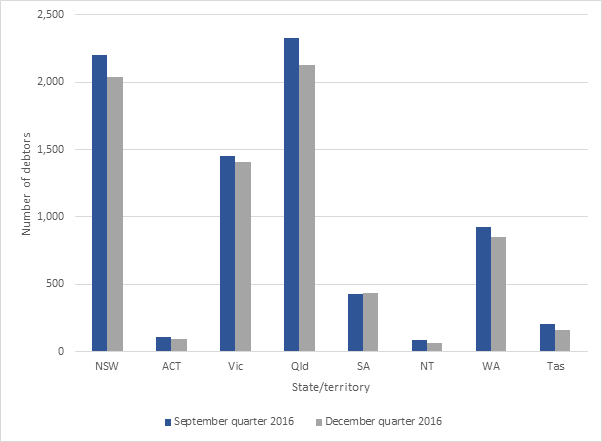

Personal insolvency in Australia: number of debtors per stats/territory

New South Wales

Greater Sydney

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 8.4%; the main contributor to the fall was Wyong

The number of debtors who entered a business related personal insolvency fell 15.6%; the main contributors to the fall were Sydney Inner City and Wyong.

Rest of NSW

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 5.8%; the main contributor to the fall was Lake Macquarie – West

The number of debtors who entered a business related personal insolvency fell 10.8%; the main contributor to the fall was Kiama – Shellharbour.

Australian Capital Territory

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 16.2%; the main contributor to the fall was Belconnen

The number of debtors who entered a business related personal insolvency fell 13.3%.

Victoria

Greater Melbourne

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 1.4%; the main contributor to the fall was Tullamarine – Broadmeadows

The number of debtors who entered a business related personal insolvency fell by 13.9%; the main contributor to the fall was Knox.

Rest of Victoria

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 7.7%; the main contributor to the fall was Ballarat

The number of debtors who entered a business related personal insolvency fell by 16.3%; the main contributor to the fall was Gippsland – South West.

Queensland

Greater Brisbane

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 7.5%; the main contributor to the fall was Springfield – Redbank

The number of debtors who entered a business related personal insolvency fell 15.5%; the main contributor to the fall was Narangba – Burpengary.

Rest of Qld

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 8.8%; the main contributor to the fall was Townsville

The number of debtors who entered a business related personal insolvency fell 11.7%; the main contributor to the fall was Toowoomba.

South Australia

Greater Adelaide

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors rose 6.4%; the main contributor to the increase was Adelaide Hills

The number of debtors who entered a business related personal insolvency fell by 10.5%.

Rest of SA

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 16.5%; the main contributor to the fall was Mid North

There were 12 debtors in the December quarter 2016, a fall from 22 in the September quarter 2016.

Northern Territory

The number of debtors fell 11.1% in Greater Darwin in the December quarter 2016 compared to the September quarter 2016

There were 20 debtors in rest of NT in the December quarter 2016, a fall from 33 in the September quarter 2016

There were 16 debtors who entered a business related personal insolvency in Northern Territory, an increase from 12 in the September quarter 2016.

Western Australia

Greater Perth

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 6.8%; the main contributor to the fall was Wanneroo

The number of debtors who entered a business related personal insolvency rose 11.5%; the main contributors to the increase were Stirling and Belmont – Victoria Park.

Rest of WA

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors fell 12.2%; the main contributor to the fall was Goldfields

The number of debtors who entered a business related personal insolvency fell 15.4%; the main contributors were Bunbury and Pilbara.

Tasmania

In the December quarter 2016 compared to the September quarter 2016:

The number of debtors who entered a personal insolvency in Greater Hobart fell 10.4%

The number of debtors fell 26.8% in rest of Tas; the main contributor to the fall was Launceston

The number of debtors who entered a business related personal insolvency in Tasmania fell by a single debtor, to 28 debtors in the December quarter 2016.

Contact Us and Collect Your Debts Faster

By submitting an enquiry online, you agree to our terms and conditions and privacy policy as stated in the footer.